For certain home purchases in rural high-needs areas, Fannie Mae will waive the appraisal in exchange for a mandatory home property inspection. These waivers are intended to reduce costs for low- to moderate-income borrowers while helping them avoid unanticipated post-purchase repairs.

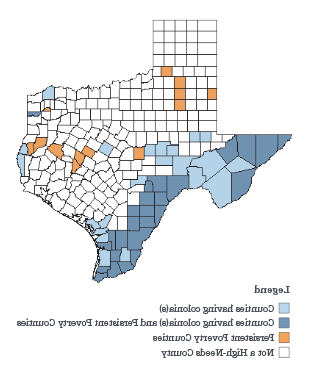

The Duty to Serve Underserved Markets rule determines which properties lie in high-needs rural areas—about 50 Texas counties are currently classified as such.

To be eligible for an appraisal waiver, the following requirements must be met:

-

- It’s only for purchase transactions.

- The loan casefile must be deemed approved/eligible through Fannie Mae’s Desktop Underwriter system.

- The property must be a one-unit principal residence property (excluding manufactured homes).

- Borrowers must have income equal to or less than 100% of the area median income.

- The loan to value ratio is no greater than 97%. The combined loan to value ratio for a Community Seconds mortgage is no greater than 105%.